Spending on residential renovation makes up just over a third of total residential construction spending. Because it accounts for this large share of total residential expenditures, Statistics ºÚÁϳԹÏÍø recently introduced a to track the cost to complete renovation projects in ºÚÁϳԹÏÍø.

In the second quarter of this year (the latest available), the index of renovation spending increased by +0.7% following a +0.8% increase in the first quarter (both percent changes being on a quarter-to-quarter basis). Compared to last year the index rose by +3.7% year over year in Q2 after posting a gain of +4.5% y/y in the Q1.

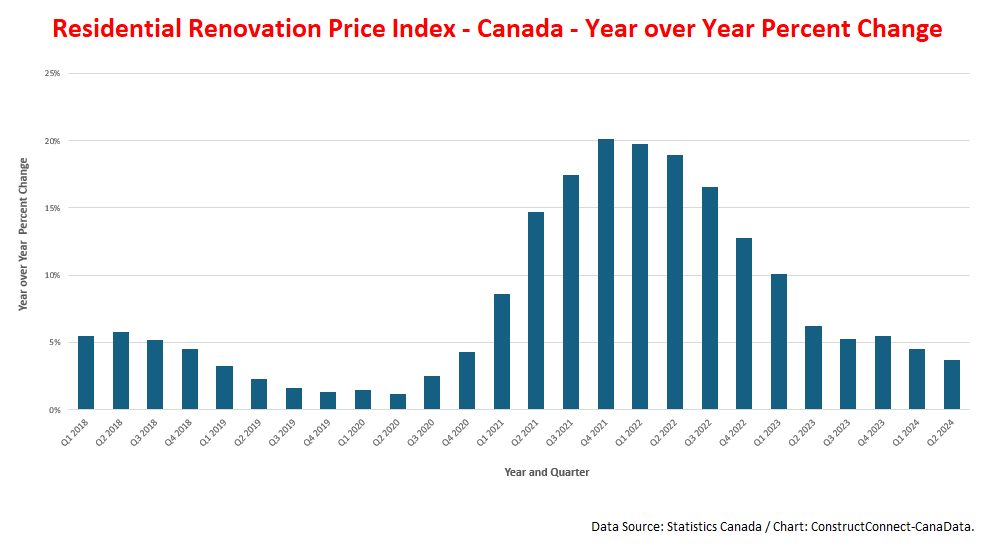

To put these percentages in perspective, in the wake of the coronavirus, the composite renovation price index peaked at +20.1% y/y in the final quarter of 2021 and it has been trending gradually lower over the past ten quarters (see chart).

Renovation prices rising faster in the West than in the East

Across the country, renovation prices in the West have outpaced the rest of the country. In British Columbia, prices are up by +5.8% y/y well ahead of the +3.7% y/y posted by the whole country.

Driven by the strong growth of permanent migration, renovation prices in Alberta are up +4.1% y/y while in Saskatchewan and Manitoba, they are ahead by +5.7% and +3.9% respectively.

In Ontario, renovation prices have risen by a +3.8% nudge, due to a solid gain in Toronto that was dampened by a more modest rise of +1.3% in Ottawa.

While price gains in New Brunswick (+2.7%) were below the national average, they were somewhat higher in Nova Scotia and Newfoundland.ÌýÌýÌý

Impact of labour shortages in West biggest driver of renovation costs

According to Statistics ºÚÁϳԹÏÍø, labour shortages drove up wages and were a major contributor to higher renovation costs, particularly in British Columbia and Alberta. Over the past 12 months construction wage rates have risen by +8.4% in Calgary and Edmonton and by +5.5% in Vancouver, Victoria, and Kelowna.

Other contributors to the increase in renovation costs have included higher charges for heating and air conditioning equipment, roofing work, exterior additions, and window and door renovations.

Cooling inflation will cause renovation costs to ease next year

As noted above and as the accompanying chart illustrates, the cost of residential renovations in ºÚÁϳԹÏÍø has been trending gradually lower over the past several quarters and there are several indicators which suggest this easing will continue over the near term.

First, the Bank of ºÚÁϳԹÏÍø’s October notes that because the Canadian economy continues to be in excess supply, pressure on the labour market has dropped, with one significant result being an increase in the unemployment rate.

This leads into the second point. The MPR also notes that near term inflation expectations have continued to fall, suggesting that the core inflation rate will remain on a gradually declining path, thereby reducing pressure on construction wages and material prices. In turn, this will lead to a further easing of interest rates.

Recent Comments

comments for this post are closed